Representative Transactions

Property Acquisitions

With a focus on value add and opportunistic real estate investment, Argent has established a multi-decade track record of investment success across all major asset classes.

Intercontinental Times Square New York, NY

Argent Ventures, in partnership with Gencom and Highgate, acquired the Times Square Intercontinental Hotel in 2025. The property is a 607-key, 36-story hotel with 20,000 square feet of flexible event space and retail. Positioned at the corner of 44th Street and 8th Avenue in the heart of Times Square, the hotel offers high visibility and unmatched access to the major attractions, transit hubs, and both corporate and leisure demand drivers. The acquisition capitalized on the opportunity to acquire a large-scale, unencumbered, institutional-quality asset in a constrained supply environment at a fraction of replacement cost.

Merritt 7 Norwalk, CT

Argent Ventures acquired buildings 301-601 within the Merritt 7 office park in 2025. The property includes four Class A office buildings measuring 945,033 square feet and is situated at the intersection of the Merritt Parkway and Route 7 in Norwalk, Connecticut. The property has benefited from a recent $24.7 million capital improvement program completed by prior ownership, including updated lobbies, common areas, amenities, and building systems. The acquisition represented a unique opportunity to acquire a best-in-class office property well below replacement value with strong in-place income.

Hyatt Regency Times Square New York, NY

Argent Ventures acquired the senior fee and leasehold mortgage and mezzanine loan secured by the interests in 1605 Broadway and subsequently purchased two related fee interests and then obtained full, fee-simple title to the property through a pre-packaged bankruptcy process. Located in the center of Times Square, 1605 Broadway is a 46-story mixed-use asset containing 795 hotel rooms, over 250,000 of commercial space, 17,800 square feet of ground-floor retail, prominent Times Square signage, and a 159-space parking garage. Following the resolution of the bankruptcy and transfer of title, Argent executed an extensive capital renovation program that repositioned the hotel under the Hyatt Regency flag and upgraded guestrooms, public areas, meeting spaces, and food-and-beverage offerings—establishing the Hyatt Regency Times Square as a premier full-service destination in the district.

High Ridge Office Park Stamford, CT

Argent acquired the defaulted senior debt secured by the fee interest in High Ridge Office Park in Stamford, CT at a significant discount. The property is approximately 38 acres and includes over 500,000 SF of commercial space.

170 Wood Avenue Iselin, NJ

Argent Ventures acquired 170 Wood Avenue in 2023. The property is a 239,452 square foot Class A office building developed in 2003 and centrally located in the Metropark office submarket. This quality trophy asset was constructed by and for the Siemens Corporation to be part of its New Jersey campus. The property features exceptional construction and highly efficient design that can be customized to meet a variety of needs. 170 Wood is the only Class A building in the submarket to offer space greater than 100,000 square feet.

White Plains Plaza White Plains, NY

Argent Ventures acquired White Plains Plaza, a 715,000 square foot Class A office and retail campus in 2022. The property consists of two 15-story towers located at 1 North Broadway and 445 Hamilton Avenue, situated within the downtown Central Business District of White Plains, New York. The acquisition represented a unique opportunity for Argent to expand its already significant footprint within the thriving downtown CBD and acquire one of the best-in-class office properties in White Plains with a diverse tenant base.

275 Main Street White Plains, NY

Argent Ventures acquired the defaulted senior debt secured by the leasehold interest in 275 Main Street and took control of the property in 2022. 275 Main Street, located in the downtown White Plains Central Business District, is a 9-story parking garage and retail property featuring 270,000 square feet of retail space. The property is adjacent to White Plains Plaza, an office and retail complex owned by Argent, and serves as the primary parking solution for the office tenants. The vacant retail component offers a unique value-add opportunity for a variety of potential uses.

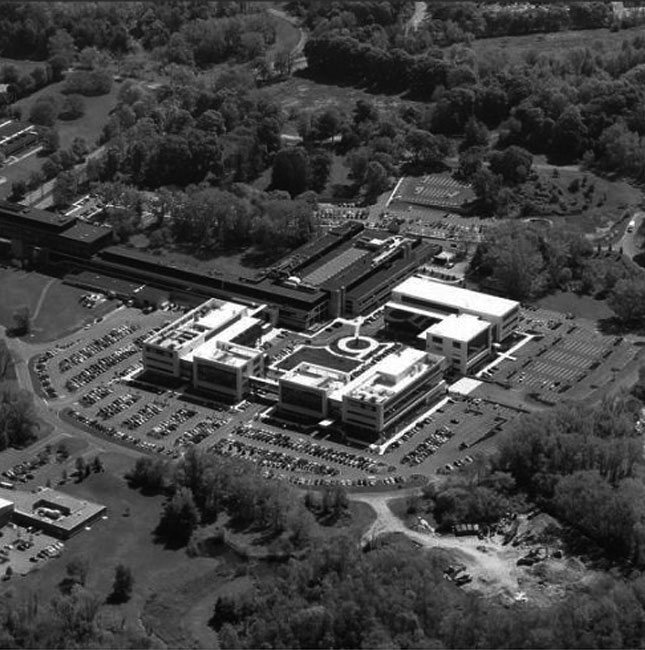

The Crossing at Tabor Road Morris Plains, NJ

Argent Ventures acquired the former global headquarters of Honeywell International in 2020. The acquisition included a long-term leaseback with Honeywell for a portion of the office and lab space. Located at 115 Tabor Road in Morris Plains, New Jersey, the property is situated in the heart of one of the most established Class A office markets in the Tri-State Metropolitan Area and features a 465,133 square foot Class A office building, structured parking garage, and helipad. The purchase of such a trophy asset, significantly below replacement costs with stable cash flow from a credit tenant, represented one of the most compelling value add opportunities in the suburban NJ market.

The Cove Jersey City, NJ

Beginning in 2015, Argent Ventures, through multiple transactions, assembled a 14-acre waterfront development site in Jersey City. Working collaboratively with city officials and neighborhood groups, Argent successfully rezoned the site to allow for up to 2,840 residential units. Zoning allows for multiple uses including residential, office, retail, hotel, laboratory and research facilities.

University Square Princeton, NJ

Argent Ventures acquired University Square, a 361,000 square foot office campus in 2019. The property, a Class A office building anchored by BlackRock, is located in Princeton, one of the strongest office markets in New Jersey. The acquisition represented a unique opportunity to acquire a best-in-class office building with long-term stable cash flow, secured by strong credit tenancy, with value-add opportunity through additional leasing.

Westchester One White Plains, NY

Argent Ventures acquired Westchester One, a 907,000 square foot Class A office building, in 2017. The property is located in the downtown Central Business District of White Plains, New York, and is anchored by New York Life. The acquisition represents a part of the Argent investment thesis to target institutionally owned and operated assets with credit tenancy that trade below replacement value.

180 Baldwin Ave Jersey City, NJ

Argent Ventures purchased this 5-acre property, located in the Journal Square section of Jersey City, in 2013. The site housed the former Muller Pasta Factory, which has since been demolished to make way for a mixed-use development with 980 residential units, retail, below-grade parking, and a publicly accessible landscaped promenade providing unobstructed views of Manhattan. Argent is co-developing the project with Jersey City-based developer Shuster Development.

Grand Central Terminal New York, NY

Argent acquired this 1.3 million square foot iconic property net leased to The Metropolitan Transit Authority of the State of New York (MTA). As part of the deal, Argent also acquired approximately 1.3 million square feet of transferable development rights and 140 miles of land under the railroad tracks.

Capitol Records Building Hollywood, CA

Argent acquired this 105,000 square foot landmark office building and recording studio located at Hollywood and Vine in a sale leaseback with EMI. The property is the centerpiece of a new, 1.2 million square foot mixed-use development Argent is planning with its joint venture partner, Millennium Partners.

150 Riverside Drive New York, NY

Argent and its joint venture partners acquired this 520-bed nursing facility in 2013. Working with its operating partners, Argent is focused on enhancing operating and financial performance by improving the asset to provide higher quality rehab and nursing services to residents.

ALTA/Park City Coop/Condo Apartment Portfolio New York, NY

Argent acquired 1,000 rent-regulated and unregulated cooperative and condominium apartments located throughout Manhattan, Brooklyn and Queens. More than 400 units have been sold to date.

Landmark at Eastview Tarrytown, NY

Argent acquired this 800,000 square foot office/lab campus that included one of the largest development sites in Westchester County from the foreclosing lender and then leased up the existing property and sold it to BioMed Realty Trust in 2004. Argent sold a retail development site to Home Depot in 2006, and sold the remaining 100 acres of adjacent development land to Regeneron Pharmaceuticals in 2015.

Starrett Corporation New York, NY

Argent and its partners successfully executed a leveraged buyout of this NYSE-listed public company. Some of its subsidiaries, including HRH Construction and Levitt Homebuilder, were sold and Grenadier Realty Corporation, a manager of more than 27,000 multifamily units in the New York metro area, was retained. Argent has since exited its position.

Omni Mall Miami, FL

Argent acquired this shuttered mall to reposition it as a telecommunications data center. When this business plan was no longer viable, Argent successfully repositioned the property to receive City of Miami approvals for a 5.5 million square foot master-planned mixed-use development. After extensive capital improvements, a portion of the property was repositioned into Class A space and leased to educational and office tenants. Argent also conducted a $56 million renovation of the 527-key hotel and reflagged it as a Hilton. The property was sold to Genting Group in 2011.

420 rue d’Estienne d’Orves Paris, France

Argent acquired this former 600,000 square foot industrial building adjacent to the La Defense district in Paris and successfully re-zoned it for office use and then developed it in partnership with HRO International. The property was sold to Gecina Group in 2006.

Pfizer Building New York,NY

Argent acquired this vacant 635,000 square foot property in a partnership with an institutional partner. The property was subsequently leased and sold to a pension fund.

300 Boulevard East Weehawken, NJ

Argent acquired this 330,000 square foot substantially vacant industrial/office building in 1999 and then conducted a repositioning to upgrade the facility into a 100% occupied, state-of-the-art telecom/data center. The property was sold to Global Innovation Partners/CalPERS in 2002.

633 Third Avenue New York,NY

Argent acquired an 185,000 square foot vacant office condominium unit in the 1.3 million square foot Class A office tower. Argent renovated and parceled the unit, which was later sold to multiple users in 2000-2001.

Fort Washington Office Center Fort Washington, PA

Argent acquired this 400,000 square foot suburban office center that was 65% occupied by a tenant with a near-term lease expiration. Argent then successfully renewed the lease and sold the property in 2000 to Heitman/CalSTRS.

Debt Acquisitions

With a focus on special situations and complex legal situations, Argent has demonstrated expertise in the acquisition and work out of distressed real estate debt.

Manhattan Mall New York, NY

Argent acquired the first mortgage on this 1.0 million square foot retail/showroom building and subsequently obtained the fee interest from the Simon family of the Simon Property Group. Argent repositioned the property into primarily Class A office space with ground floor retail through an $80 million redevelopment. The property was sold to Vornado Realty Trust in 2007.

Echelon Condominium New York, NY

Argent acquired the debt secured against this 54-unit condominium development in 2012. After negotiations with the borrower, Argent successfully liquidated its position in 2013.

Chrysler Building New York, NY

Argent acquired the key debt position on this 1.2 million square foot property and then orchestrated the purchase of the fee in a partnership with Tishman Speyer.

313 Gold Street New York, NY

Argent acquired the senior mortgage secured by a 17,000 square foot residential development site in downtown Brooklyn with 250,000 buildable square feet. Argent’s position was successfully liquidated in 2013.

166 West 75th Street New York, NY

Argent acquired the senior mortgage secured by a 207-unit hotel partially occupied by rent stabilized tenants in 2011. Property was subsequently sold.

One Park Avenue New York,NY

Argent acquired the senior mortgage on this 66% occupied, 920,000 square foot Class A office tower and then obtained the fee interest through a work out. After taking title, Argent successfully executed an extensive renovation, released vacant space and sold the building to SL Green in 2001.

17 Battery Place New York,NY

Argent acquired the mortgage on the leasehold of this 1.2 million square foot building, subsequently consolidating the leasehold and fee interest to sell the property.